SOLUTION

Enterprise Risk Management (ERM)

Holistic Insight

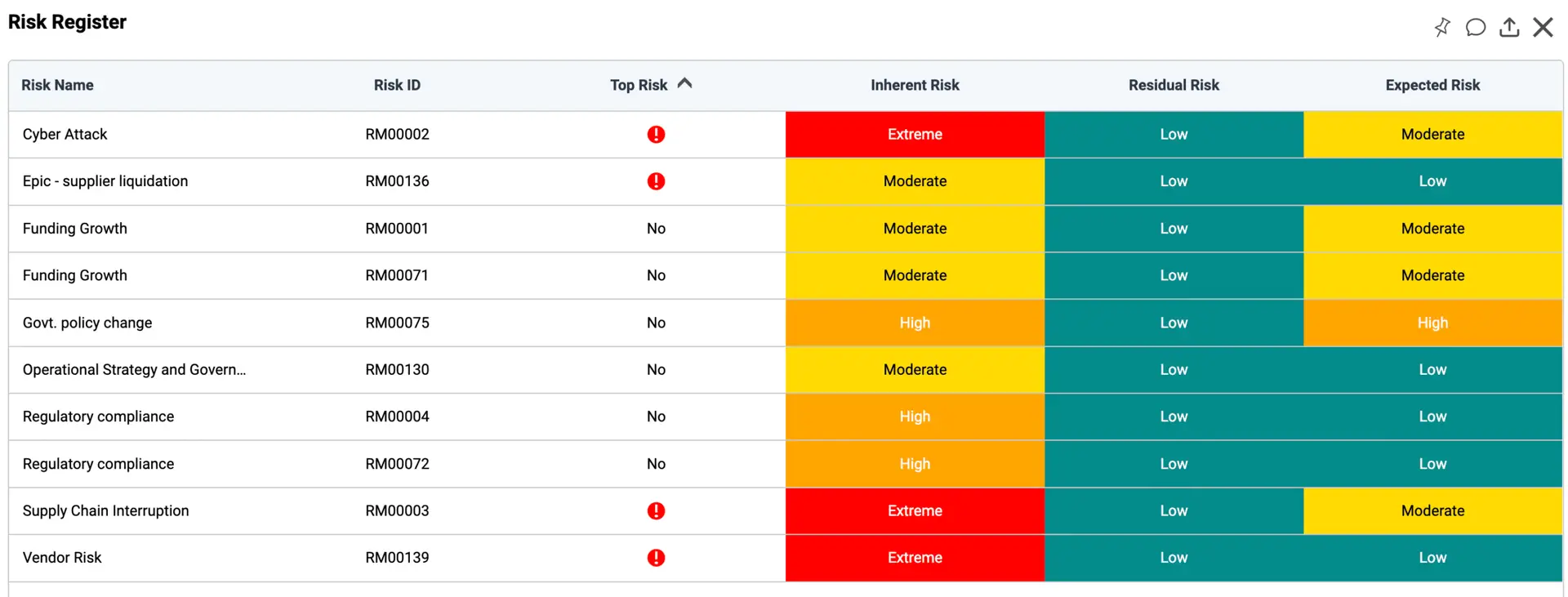

Identify and assess risks across your entire organization in real time.

Centralize risk data to gain a clear, unified view.

Automate risk scoring and prioritization with configurable rules.

Generate reports and dashboards for confident decision making.

“Our business is global and changes daily. The ability to easily move plans and folders within CLDigital with no coding saves us a ton of time every year.”

Chief Information Officer

- Large Insurance Company (UK)

“CLDigital gave us real-time visibility and control, bringing risk and compliance into one coherent view.”

Chief Risk Officer

- Global Financial Institution (UK)

“We replaced dozens of spreadsheets and legacy systems with one intuitive dashboard with no code required.”

Enterprise Risk Manager

- U.S. Healthcare Organization

Strategic Alignment

Align risk mitigation efforts with business objectives.

Monitor key risk indicators and set proactive alerts.

Quantify risks using impact and likelihood metrics for objective analysis.

BENEFITS

Complete Risk Visibility

Strategic Risk Insights

Prioritized Investments

Enhance Resilience

FAQ

Solution FAQs

What is Enterprise Risk Management?

What are the key functionalities of ERM?

The key functionalities include enterprise-wide risk identification, assessment and scoring, centralized risk registers, analytics dashboards, scenario planning, heatmaps, and alignment with strategy.

What are the five components of an ERM framework?

CLDigital delivers a comprehensive Enterprise Risk Management (ERM) solution built upon the five core pillars of the COSO framework:

Control Environment

Risk Assessment

Control Activities

Information and Communication

Monitoring

Our services integrate these components into your organizational DNA, beginning with the establishment of a risk-aware culture and the alignment of strategic goals with your specific risk appetite. By leveraging our platform, your firm can systematically identify and prioritize risks through advanced performance analytics, conduct continuous reviews to adapt to shifting market conditions, and maintain transparent reporting channels that ensure stakeholders have access to real-time, actionable data for informed decision-making.

What ERM services does CLDigital provide?

CLDigital delivers a cloud platform that centralizes risk registers, automates scoring, tracks key risk indicators, enables configurable workflows, and creates real-time dashboards. Advisory support helps you align the system with your strategy and train your team.

What are the benefits of ERM?

What are the challenges of ERM?

Can you give an example of ERM in action?

CLDigital transforms theoretical ERM into a strategic asset, as demonstrated by our work with technology and financial firms facing escalating cyber threats. By deploying the CLDigital 360 platform, these organizations move beyond static risk registers to a dynamic environment where cyber threats are mapped directly to business assets and automated controls. For example, a global organization can utilize CLDigital’s real-time monitoring and no-code dashboards to rank risks by impact and likelihood, automatically triggering remediation workflows the moment a vulnerability is detected. This integrated approach provides “board-ready” transparency through live reporting. By centralizing risk, compliance, and performance into a single source of truth, CLDigital enables leadership to make data-driven decisions that strengthen operational resilience and build lasting stakeholder confidence.

GET STARTED

Let's Connect

Discover how our platform can help you achieve better outcomes and you prepare for what’s next in risk and resilience.