Operational Resilience

Financial services firms (and increasingly, other industries) are being pushed harder than ever to prevent, adapt to, respond to, and recover and learn from operational disruptions. They require a platform that can scale and expand with their programs. CLDigital 360 gives users the ability to map the complex web of interactions existing across multiple departments between processes, applications, and suppliers required to provide important business services.

The CLDigital 360 Operational Resilience app is built to manage the complexity and restructuring that occurs in many organizations. Business services change and evolve; mergers and acquisitions occur; reorganizations change reporting structures; and business processes shift in importance. CLDigital 360 allows clients to make changes to organizational structures, forms, fields, reports, and plans without developer coding.

Key Components:

- Privileged role-based access

- Real-time gap analysis

- Business Impact Analysis (BIA) for services

- Visual dependency mapping of the customer journey

- Impact tolerance identification

- Integrated testing and exercising

- Boardroom worthy plan output built in MS Word

- Simple or advanced workflows

- No-code configuration and change management

- Mobile browser and native mobile app

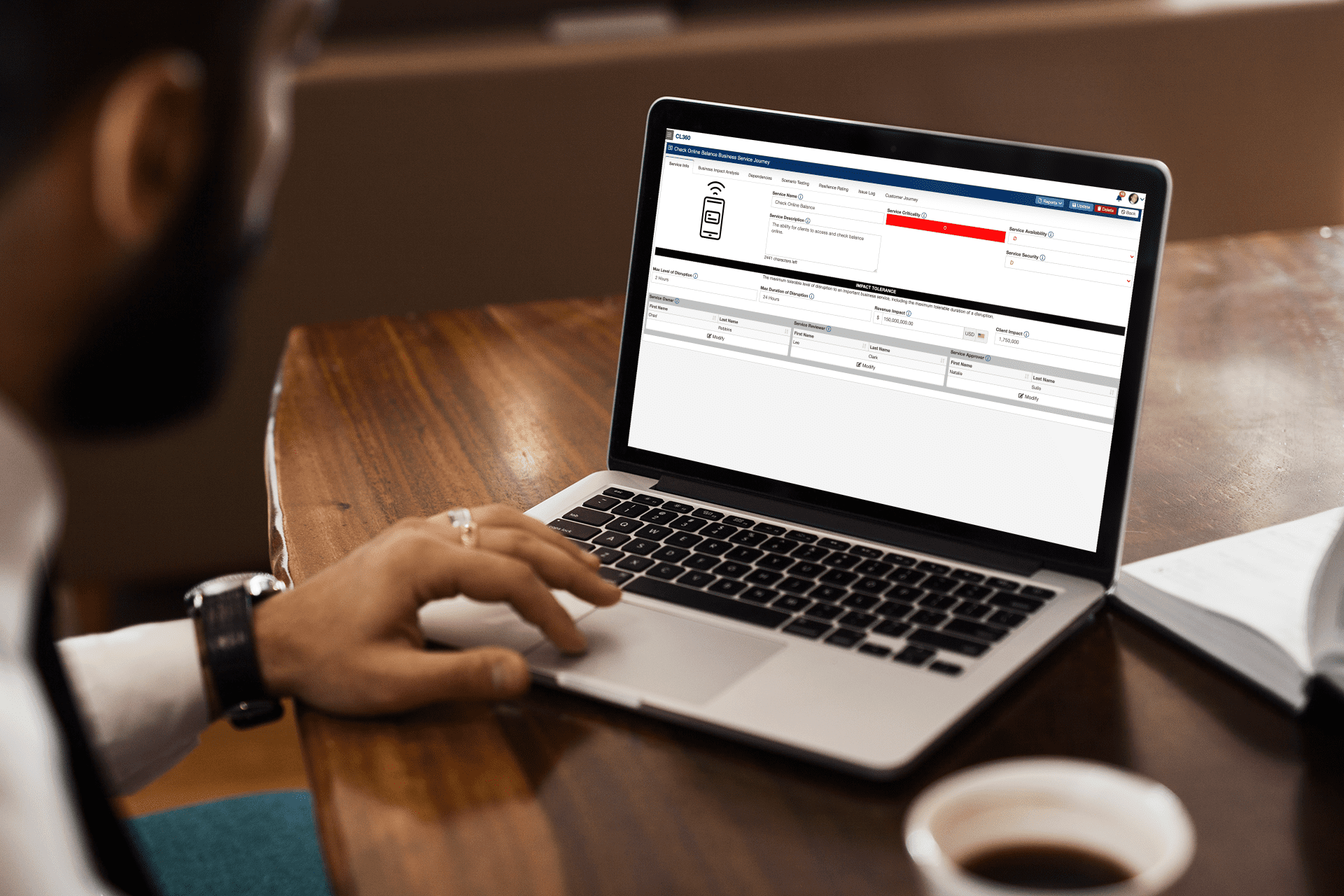

Visually Map the Customer Journey

CLDigital 360 gives organizations the ability to maintain programs over time, even as the demands upon those programs change. By mapping business services to the underlying people, processes, technology, locations, and vendors, CLDigital 360 users build operational intelligence and insights that can be applied to any number of business and/or recovery strategies. To meet these recommendations, CLDigital 360 empowers clients to:

- Capture impact tolerances at the Business Service level and push that tiering down to supporting processes, suppliers, and technologies while creating a complete “mapping”

- Conduct business impact analyses on multiple levels (Business Service, Process, Technology, Third Parties, etc.).

- Trigger workflows when intelligence discovers gaps between downstream dependencies and upstream relationships.