SOLUTION

GRC (Governance, Risk, and Compliance)

One Connected Framework

Eliminate the inefficiencies of juggling multiple platforms and spreadsheets.

Bring governance, risk, and compliance together into a single, flexible framework that adapts to changing regulations.

You gain consistency across policies and processes, while reducing the cost and effort of managing overlapping frameworks.

“Our business is global and changes daily. The ability to easily move plans and folders within CLDigital with no coding saves us a ton of time every year.”

Chief Information Officer

- Large Insurance Company (UK)

“CLDigital gave us real-time visibility and control, bringing risk and compliance into one coherent view.”

Chief Risk Officer

- Global Financial Institution (UK)

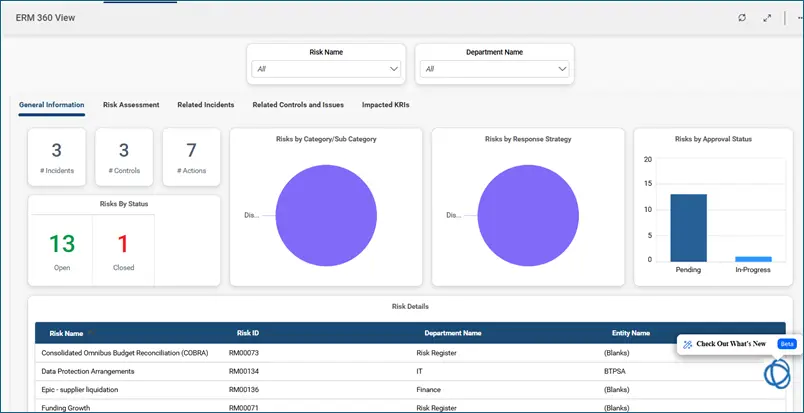

“We replaced dozens of spreadsheets and legacy systems with one intuitive dashboard with no code required.”

Enterprise Risk Manager

- U.S. Healthcare Organization

Clarity and Control

Competing priorities and complex reporting often leave teams chasing data instead of driving outcomes.

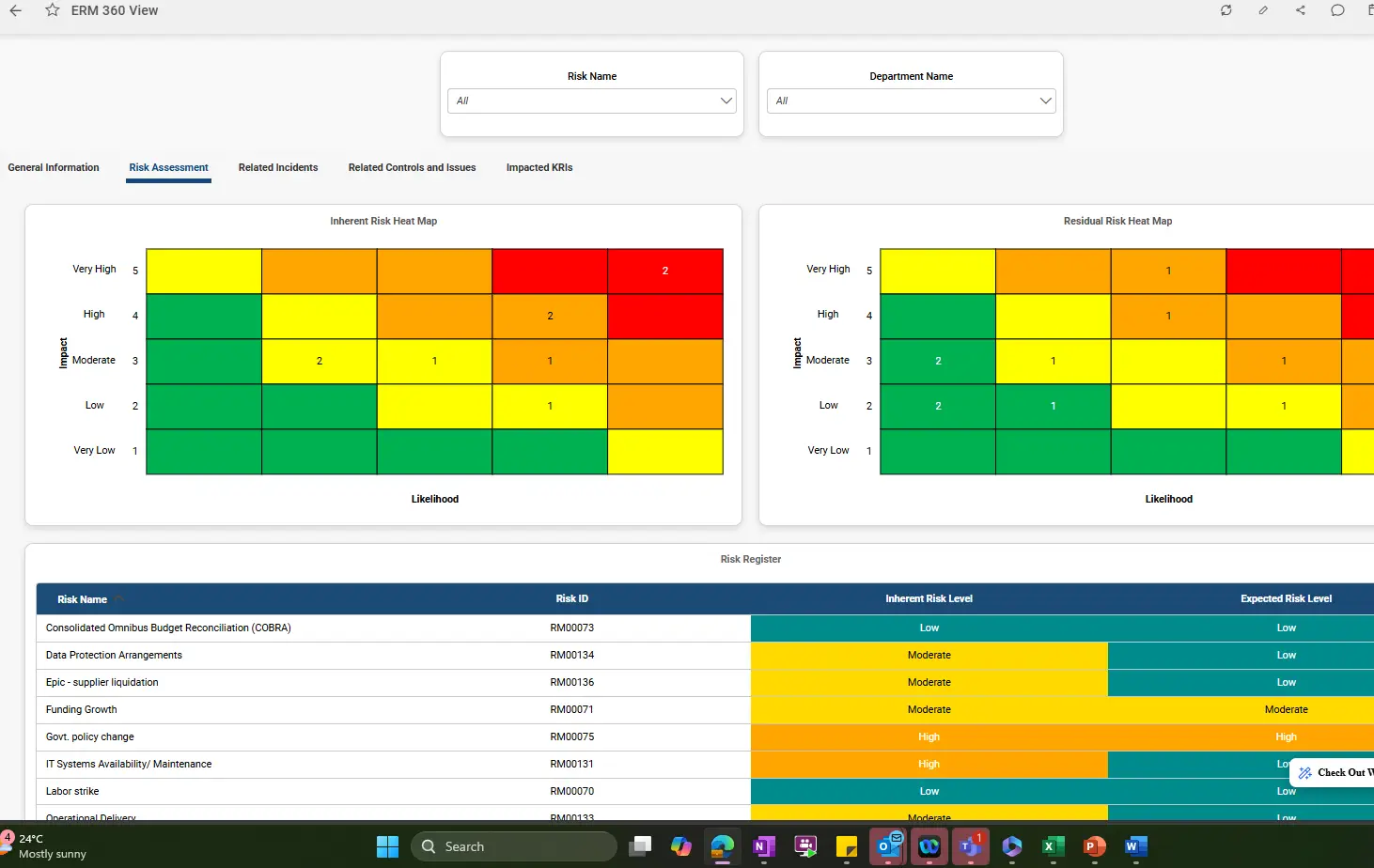

With real-time visibility, you can cut through the noise, spot gaps before they escalate, and present accurate, audit-ready evidence when it matters most.

That means faster decisions, stronger oversight, and greater confidence from regulators, boards, and stakeholders alike.

BENEFITS

Consistent Governance

Reduce Complexity

Build Confidence

Focus on Performance

FAQ

Solution FAQs

What is GRC?

What are the key functionalities of GRC?

How to implement a GRC framework?

Define corporate goals and regulatory drivers.

Choose or tailor a framework that fits your industry.

Inventory existing policies, processes, and risks.

Map controls to requirements and assign owners.

Centralize through a software platform, like CLDigital, for workflows and evidence.

Train users, launch, and review progress each quarter.

What are the benefits of GRC?

What are the challenges of GRC?

What Are the Challenges of GRC?

Modern Governance, Risk, and Compliance (GRC) initiatives present several interconnected hurdles, primarily stemming from fragmented frameworks where individual departments operate in silos. This lack of coordination creates “blind spots” and duplicate work, as each unit utilizes its own disparate data and processes. These internal silos are further strained by a volatile landscape of overlapping or changing regulations, making it nearly impossible for manual systems to maintain pace with the volume of global updates. When organizations continue a reliance on spreadsheets and disconnected tools, they suffer from “compilation nightmares” and high error rates, as static documents cannot provide the real-time insights required for modern risk management.

Collectively, these challenges lead to higher compliance costs and significant gaps in accountability, leaving leadership without a clear, auditable “source of truth” to guide strategic decisions.

CLDigital is purpose-built to dismantle these barriers by unifying your entire GRC ecosystem into a single, no-code platform. We eliminate fragmentation by centralizing risk, controls, and obligations, allowing different departments to share data and insights seamlessly. Our platform automates the mapping of a single control to multiple regulatory frameworks (such as NIST, ISO, etc.), effectively solving the problem of overlapping requirements while drastically reducing manual lift. By replacing spreadsheets with CL360’s real-time dashboards and automated evidence collection, we provide the transparency needed to close accountability gaps and lower operational costs.

With CLDigital, your organization moves from a reactive, “check-the-box” mentality to a proactive stance of Principled Performance, where risk management becomes a driver of business value rather than a burden.

GET STARTED

Let's Connect

Discover how our platform can help you achieve better outcomes and you prepare for what’s next in risk and resilience.