SOLUTION

Insurance

Insurers excel at assessing risk, but protecting operations during disruption is equally vital. Get resilience that sustains policyholder trust.

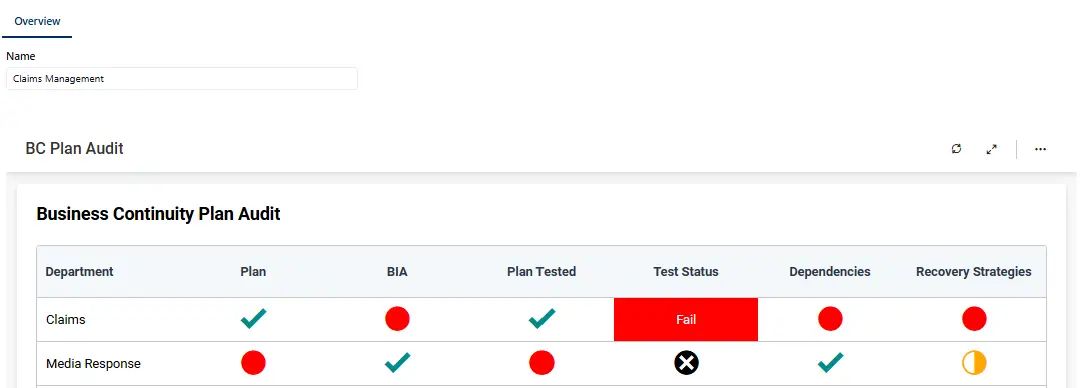

Stronger Risk Oversight

Anticipate challenges with integrated continuity planning, third-party oversight, and enterprise-wide testing.

CLDigital 360 equips insurers to safeguard operations, monitor supplier performance, and prepare for complex disruptions with confidence.

“Our business is global and changes daily. The ability to easily move plans and folders within CLDigital with no coding saves us a ton of time every year.”

Chief Information Officer

- Large Insurance Company (UK)

“CLDigital gave us real-time visibility and control, bringing risk and compliance into one coherent view.”

Chief Risk Officer

- Global Financial Institution (UK)

“We replaced dozens of spreadsheets and legacy systems with one intuitive dashboard with no code required.”

Enterprise Risk Manager

- U.S. Healthcare Organization

Trust That Endures

Maintain regulator and policyholder confidence with transparent governance and proven compliance.

By embedding resilience across operations, insurers can reduce risk exposure, respond faster under pressure, and reinforce the trust that defines enduring customer relationships.

BENEFITS

Protect Policyholder Trust

Industry Compliance

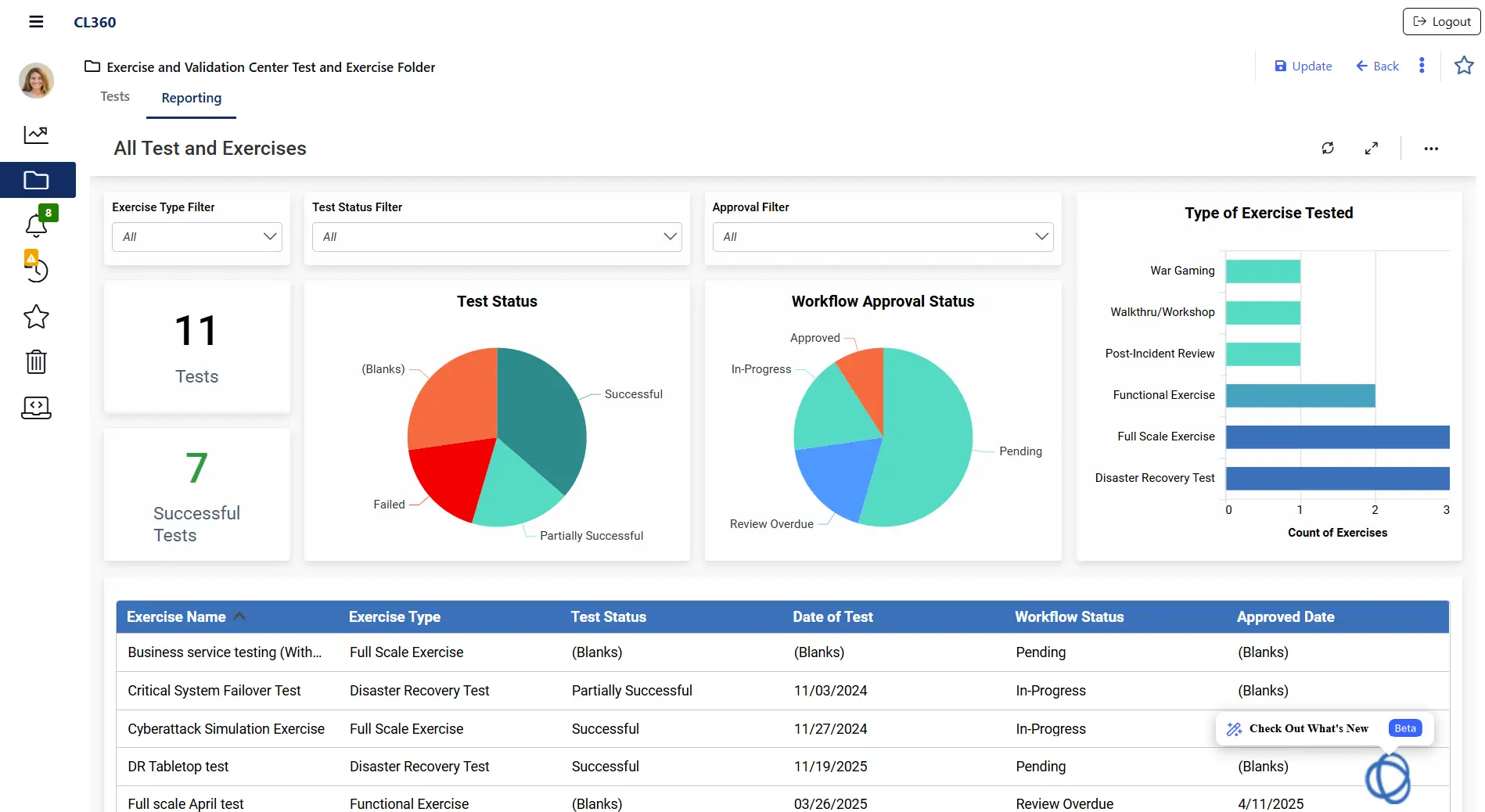

Proactive Risk Testing

Enhanced Resilience

FAQ

Solution FAQs

Where do insurers struggle most with resilience?

What are the consequences of weak resilience in insurance?

How does risk and resilience software support insurers?

GET STARTED

Let's Connect

Discover how our platform can help you achieve better outcomes and you prepare for what’s next in risk and resilience.