Enterprise Risk Management (ERM) has become a critical component of strategic planning and decision-making in the rapidly evolving business environment as organizations navigate digital transformation. The complexity and scope of risks they face are expanding, necessitating a more integrated and technology-driven approach to risk management. With its holistic view of organizational risks, ERM is well-positioned to address these challenges and turn them into opportunities.

The Changing Risk Landscape

The digital era has brought about a new set of risks. Cybersecurity threats, data privacy concerns, and technology disruptions are just a few examples of the emerging risks that organizations must manage. These risks are not confined to the IT department; they have broad implications for business continuity and operational resilience. Business continuity involves maintaining essential functions during and after a disaster has occurred, ensuring that a company can continue to serve its customers, mitigate losses, and recover operations swiftly. Operational resilience, on the other hand, is the ability of an organization to resist, absorb, and recover from or adapt to an adverse occurrence during operation that may cause harm, destruction, or loss of ability to perform mission-related functions.

Both these aspects are crucial in managing the risks in the digital era.

GRC vs ERM: Understanding the Difference

Governance, Risk, Compliance (GRC), and Enterprise Risk Management (ERM) are fundamental concepts in risk management. While often used interchangeably, there are distinct differences between the two.

GRC refers to a strategy for managing an organization's overall governance, enterprise risk management, and compliance with regulations. It involves coordinating strategy, processes, technology, and people to drive effective decision-making and foster a risk- aware culture. The four components of GRC are strategy, processes, technology, and people. These elements work together to ensure that an organization's governance framework, risk management strategies, and compliance protocols are practical and aligned with business objectives.

On the other hand, ERM is a process led by senior leadership designed to identify potential events that may affect the entity and manage risk to be within its risk appetite to provide reasonable assurance regarding achieving entity objectives.

However, ERM often faces three significant challenges:

- Lack of integration across the organization

- Insufficient support from senior management

- A reactive rather than proactive approach to risk management

These challenges can hinder the effectiveness of ERM and prevent organizations from realizing its full benefits.

Types of Enterprise Risk

Enterprise risk is broadly categorized into operational, financial, and strategic risks.

Operational risks are associated with the day-to-day operations of the organization. They can arise from breakdowns in internal processes, people, and systems. Examples include supply chain disruptions, system failures, and regulatory compliance breaches.

Financial risks are related to the financial structure of the company and its transactions. They include market movements, liquidity, credit, and foreign exchange risks.

Strategic risks affect the company's long-term goals, mission, or strategy driven by changes in the business environment, disruptive technology, declining market demand, or poor decision-making.

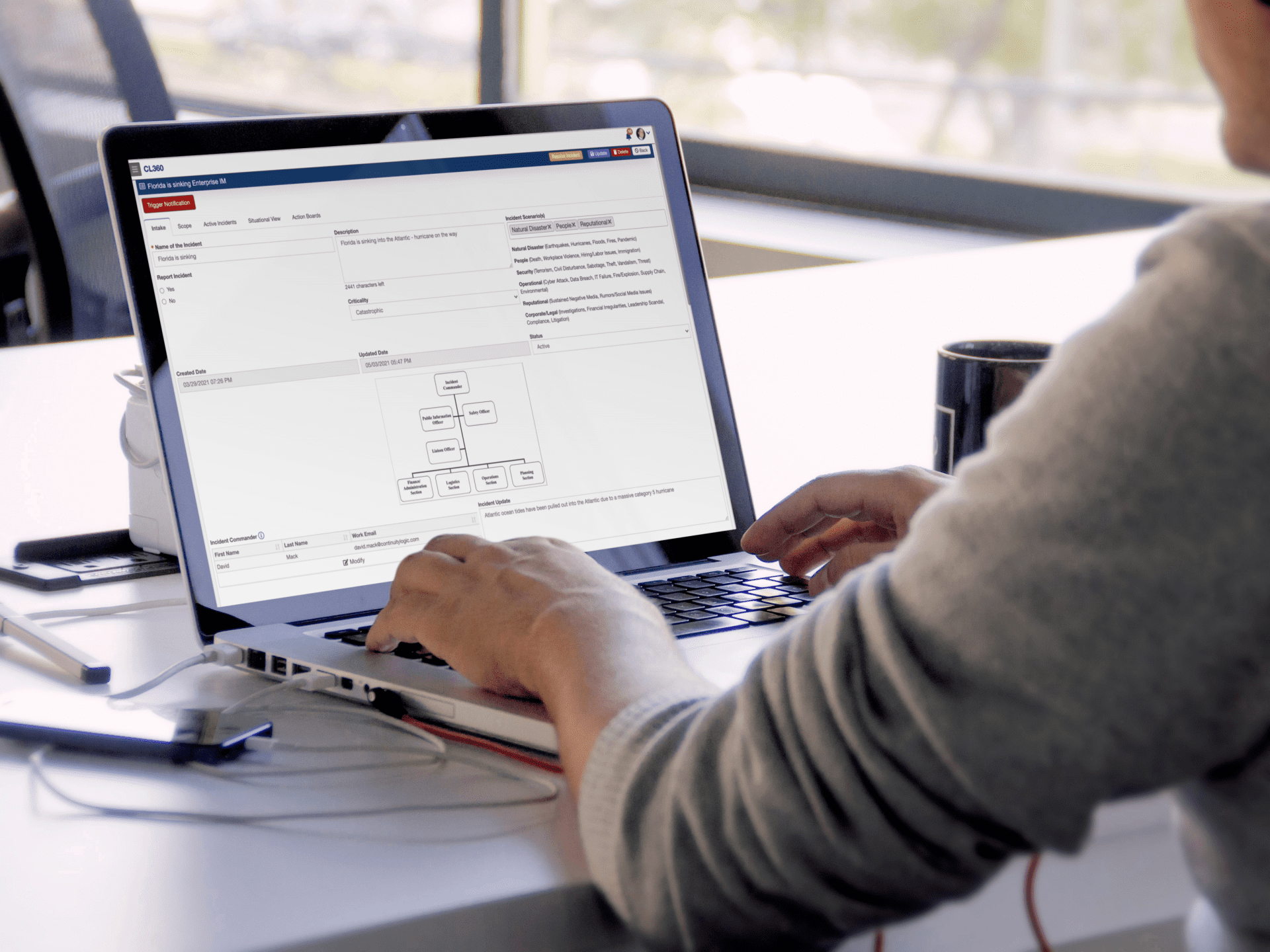

Business Continuity, Disaster Recovery and Crisis Management play a crucial role in mitigating these risks. Disaster Recovery involves recovering one or more information systems at an alternate facility in response to a major hardware or software failure or destruction of facilities. Crisis Management, on the other hand, involves the procedures organizations use to deal with a disruptive and unexpected event that threatens to harm the organization or its stakeholders.

Embracing Technology-Driven ERM Approaches

In the digital era, organizations need to embrace technology-driven ERM approaches. Advanced technologies can significantly enhance risk identification, assessment, and mitigation processes.

Incident Management Software, for instance, can help organizations manage and coordinate their response to incidents, ensuring a swift and effective resolution. It can provide real-time visibility into incident status, streamline communication, and automate tasks, thereby reducing the time to resolution and minimizing the impact on the business.

Similarly, Enterprise Risk Software can provide a comprehensive view of risks across the organization, enabling better decision-making. It can help identify and assess risks, develop mitigation strategies, and track the effectiveness of risk management activities. Integrating risk data across the organization can provide insights that help align risk management with business objectives.

By leveraging these technology-driven approaches, organizations can manage their risks more effectively and turn them into strategic opportunities.

Improving Enterprise Risk Management

Improving Enterprise Risk Management (ERM) involves strategic planning, effective communication, and advanced tools and technologies. Here are some practical steps to enhance your ERM:

- Align ERM with Business Objectives: ERM should be closely aligned with the organization's strategic objectives to ensure that risk management activities support achieving business goals.

- Promote a Risk-Aware Culture: Foster a culture where every employee understands risk management's importance and role in it. Regular training and communication can help in this regard.

- Leverage Technology: Use advanced ERM software to automate risk identification, assessment, and mitigation processes to improve efficiency and provides a more comprehensive and accurate view of risks.

- Regularly Review and Update Your ERM Strategy: The risk landscape constantly changes. Regular reviews and updates ensure that your ERM strategy remains relevant and effective.

Third-Party Risk Management plays a crucial role in improving ERM. It involves identifying, assessing, and managing the risks associated with third-party relationships. By effectively managing third-party risks, organizations can avoid potential disruptions, protect their reputation, and ensure compliance with regulations.

GRC Risk Management: Mitigation and Remediation

Governance, Risk, and Compliance (GRC), typically involves several phases:

- Risk Identification: Identifying the risks that could affect the organization's ability to achieve its objectives.

- Risk Assessment: Evaluating the likelihood and impact of the identified risks.

- Risk Mitigation: Implementing strategies to manage the risks.

- Risk Monitoring and Reporting: Regularly monitoring the risks and reporting on their status to ensure the ongoing effectiveness of the risk management strategies.

In this context risk mitigation involves:

- Implementing strategies to reduce the risk's likelihood or impact, including implementing controls.

- Transferring the risk to another party (for example, through insurance).

- Avoiding the risk altogether.

Risk remediation in GRC refers to resolving identified risks that involves correcting a compliance issue, addressing a security vulnerability, or implementing a control to manage risk.

By effectively managing risks in GRC, organizations can protect themselves from potential losses and seize opportunities that arise from uncertainty.

Embracing the Digital Future of Enterprise Risk Management with CLDigital

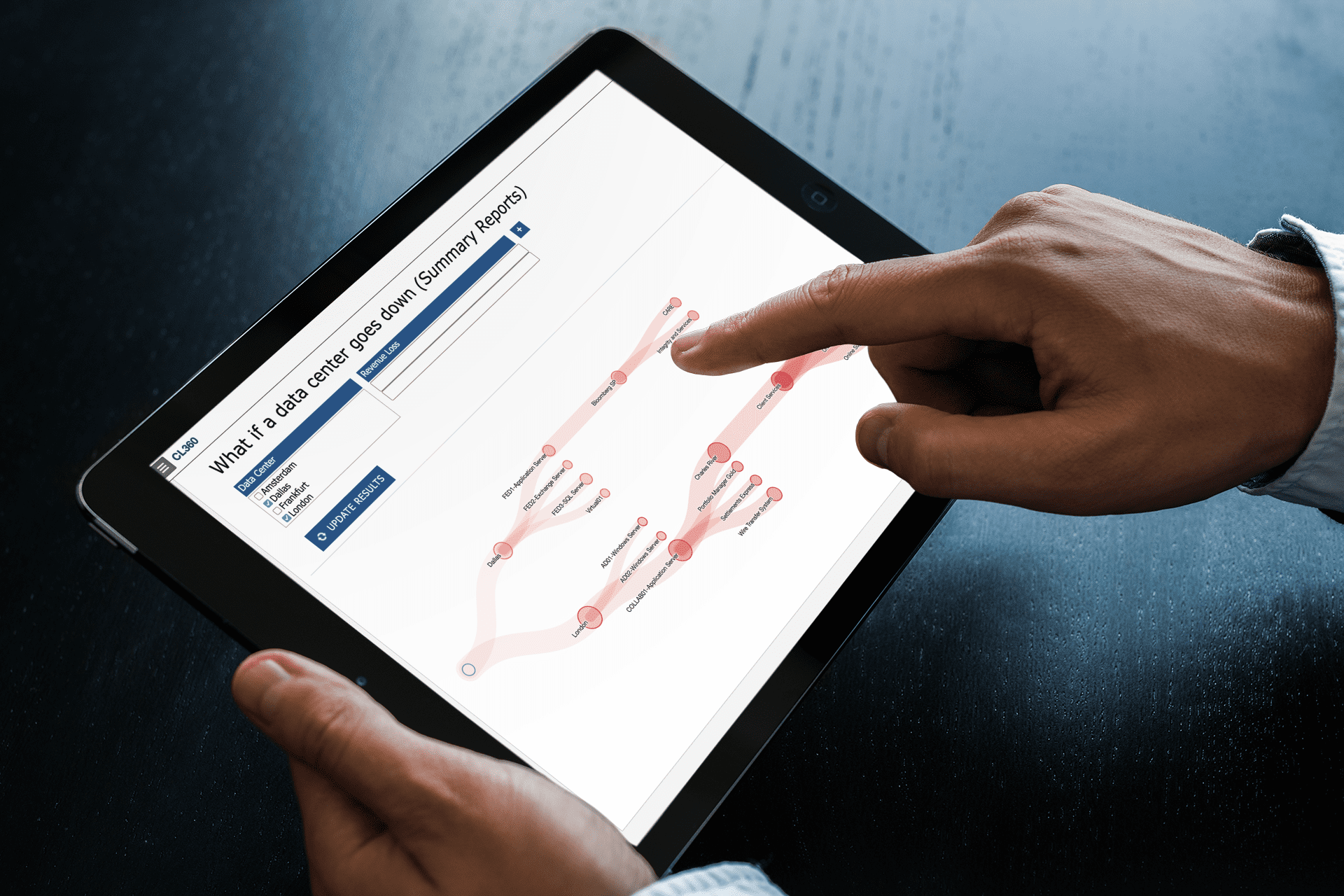

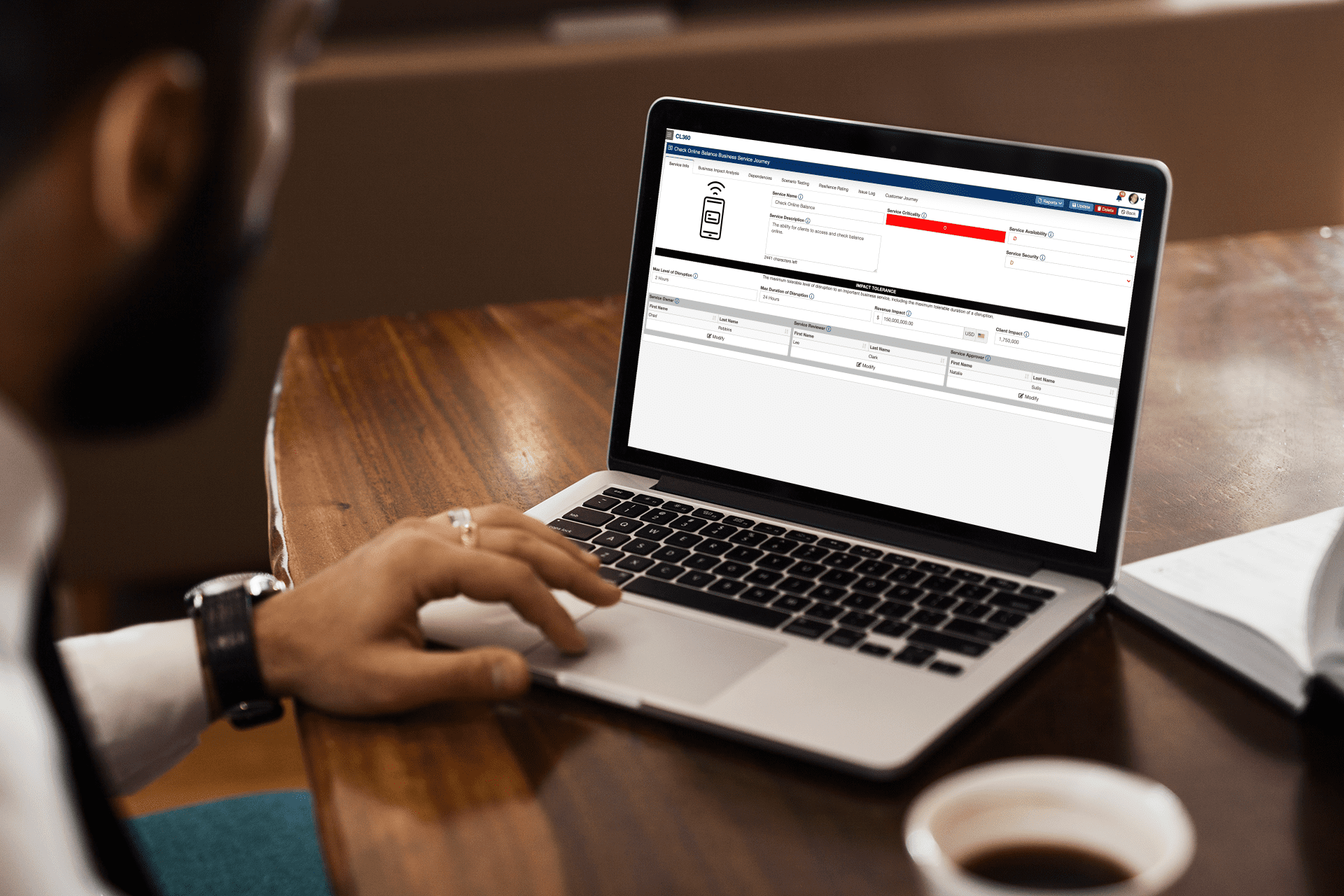

As we navigate through the digital era, the future of Enterprise Risk Management (ERM) lies in embracing technology and innovation. CLDigital's comprehensive platform, CL360, is at the forefront of this digital transformation, providing solutions that address the evolving risk landscape.

CL360's no-code development platform, analytics, data integrations, configurable document design, mobility, business process automation, flexible data model, hosting, and security solutions provide a comprehensive and effective risk management framework. Combined with our solutions for Business Continuity, Operational Resilience, Disaster Recovery, Crisis Management, Incident Management, and Third- Party Risk Management, these features provide a holistic approach to managing risks in the digital era.

Our solutions are not just about compliance; they are strategic tools for managing uncertainty and driving business performance. CL360 enhances risk identification, assessment, and mitigation processes by leveraging data analytics and automation. It turns risks into opportunities, ensuring the sustainability and success of organizations in the digital era.

As we move forward, the organizations that will thrive view ERM not just as a compliance requirement but as a strategic tool for managing uncertainty and driving business performance. CLDigital is here to guide you through this journey, providing the tools and expertise you need to navigate the digital risk landscape.

If you're ready to embrace the digital future of ERM, we invite you to schedule a demo of our comprehensive risk management solutions. Discover how CLDigital's technology-driven approach can help you manage risks more effectively and turn them into strategic opportunities.